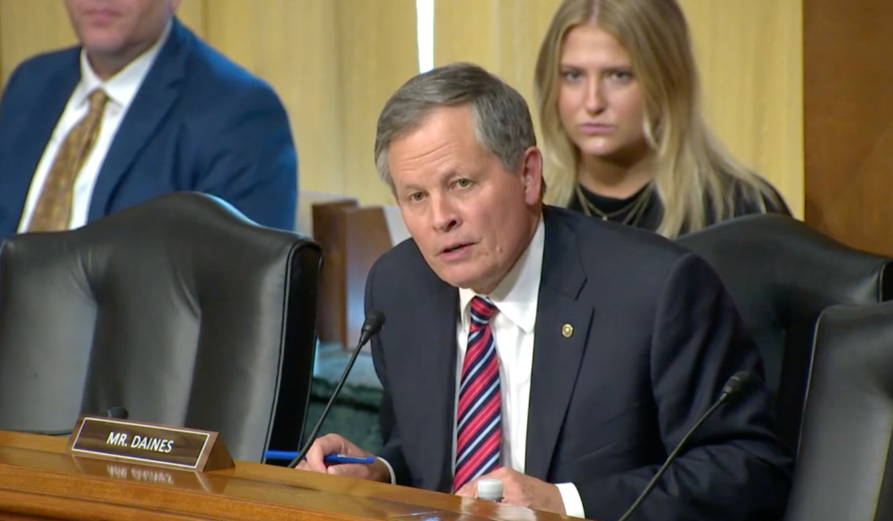

U.S. Senator Steve Daines today at a Senate Finance Committee hearing slammed President Biden and Vice President Harris for waging a tax war on main street businesses and families already living paycheck to paycheck. Daines called out Vice President Harris’ plan to repeal the 20 percent deduction for small and family-owned small businesses. Daines is working to make this deduction permanent.Daines Slams Biden-Harris Tax Hikes on Small Businesses, Montana Families

Watch Daines’ opening remarks HERE.

“Despite their rhetoric, Vice President Harris and the Democrats are launching a war on our main street businesses and Americans who are already living paycheck to paycheck. In fact, Wall Street Journal earlier this year called this the $6 trillion election because we’re looking at a $6 trillion tax hike if President Biden’s Vice President, Kamala Harris and Democrats have their way. From the Vice President’s tie-breaking vote imposing invasive 1099-K requirements, supersizing the IRS and her call to repeal the pass-through deduction, her record is crystal clear,” Daines said.

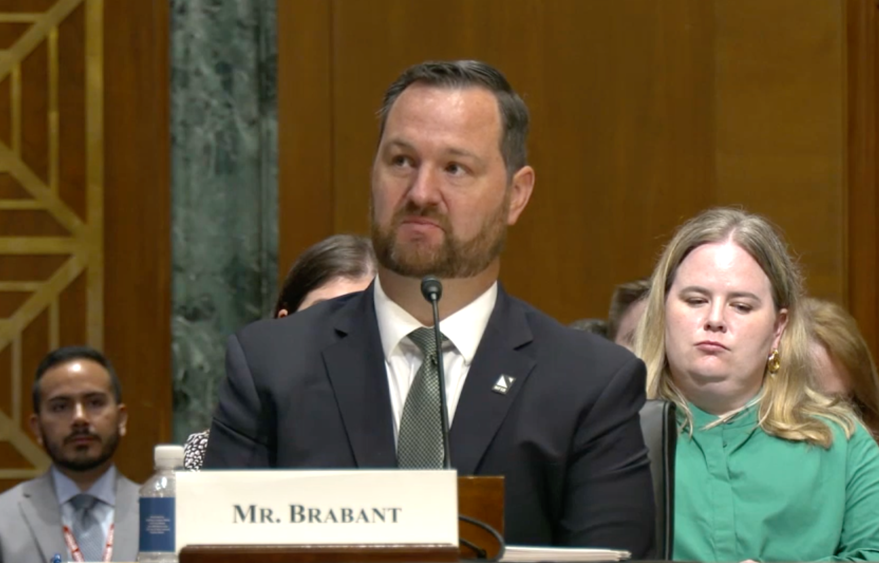

Daines also pressed Jeff Brabant, NFIB Vice President of Federal Government Relations, on how the Biden-Harris tax hikes will affect small businesses.

Watch HERE.

Mr. Brabant said, “It would be difficult for them. A recent survey shows 66 percent would increase prices, and about 44 percent would delay, postpone, or cancel planned capital investments in their small businesses.”

Background:

Daines is fighting to make the 20 percent pass-through business tax deduction permanent. His bill, the “Main Street Tax Certainty Act,” will support Montana small businesses, help create jobs and strengthen our economy. Without congressional action the tax deduction will expire at the end of 2025.

Earlier this week, Daines shared a study from Ernst and Young (EY) highlighting the economic activity supported by this tax deduction, including 2.6 million jobs and $325 billion of GDP.